Name

动向指标与-Hull-平均线组合策略DMI-and-HMA-Combination-Strategy

Author

ChaoZhang

Strategy Description

该策略采用动向指标(DMI)和Hull移动平均线(HMA)的组合,利用DMI判断市场方向,HMA确认趋势力度,实现无风险管理的交易。

-

计算真实波幅(True Range)、多头动向指标(DIPlus)、空头动向指标(DIMinus)和平均方向指数(ADX)。

-

计算快速Hull平均线(fasthull)和慢速Hull平均线(slowhull)。

-

触发做多条件:DIPlus上穿DIMinus且fasthull上穿slowhull。

-

触发做空条件:DIMinus下穿DIPlus且fasthull下穿slowhull。

-

满足做多做空条件后分别发出做多和做空信号。

该策略结合趋势判断指标DMI和Hull均线的双重确认,可以有效识别市场趋势方向,避免多头市和空头市的反复。无风险管理降低了交易频率,从长期来看整体盈利水平良好。

该策略最大的风险在于无止损设置,行情出现剧烈波动时无法有效控制亏损。此外,参数优化空间有限,针对性不强也是一大缺点。

可以通过加入移动止损、优化参数组合等手段来减少风险。

-

加入ATR止损,利用真实波幅trailing止损。

-

优化Hull周期参数,找到最佳组合。

-

动态调整做多做空的参数门槛。

-

加入量能指标等过滤器,确保趋势持续。

DMI和HMA的组合策略,判断精准,简单有效,适合中长线操作。加入适当的止损和参数优化后,可以成为非常出色的趋势追踪系统。

||

This strategy combines Directional Movement Index (DMI) and Hull Moving Average (HMA) to identify market direction with DMI and confirm trend strength with HMA, without risk management.

-

Calculate True Range, DIPlus, DIMinus and ADX.

-

Calculate fast and slow Hull Moving Averages (HMA).

-

Trigger long entry when DIPlus crosses over DIMinus and fast HMA crosses over slow HMA.

-

Trigger short entry when DIMinus crosses below DIPlus and fast HMA crosses below slow HMA.

-

Place long/short orders upon entry signals.

The double confirmation from trend indicator DMI and Hull MA ensures accuracy in capturing market trend and avoids whipsaws. The absence of risk management reduces trading frequency and leads to overall profitability in long run.

The key risk comes from no stop loss, failing to control losses when huge market swings happen. Also the limited tuning space and weak adaptiveness are deficiencies.

Possible solutions include adding moving stop loss, optimizing parameter mix etc.

-

Add ATR trailing stop loss based on True Range.

-

Optimize Hull periods to find best mix.

-

Dynamic threshold for long/short signals.

-

Add momentum filter to ensure trend continuity.

The DMI and HMA combination performs outstandingly in identifying trends with simplicity and efficiency. With proper stop loss and parameter tuning, it can become a great trend following system.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 29 | Hull 1 length |

| v_input_2 | 2 | Hull 2 length |

| v_input_3 | 76 | Length for DI |

Source (PineScript)

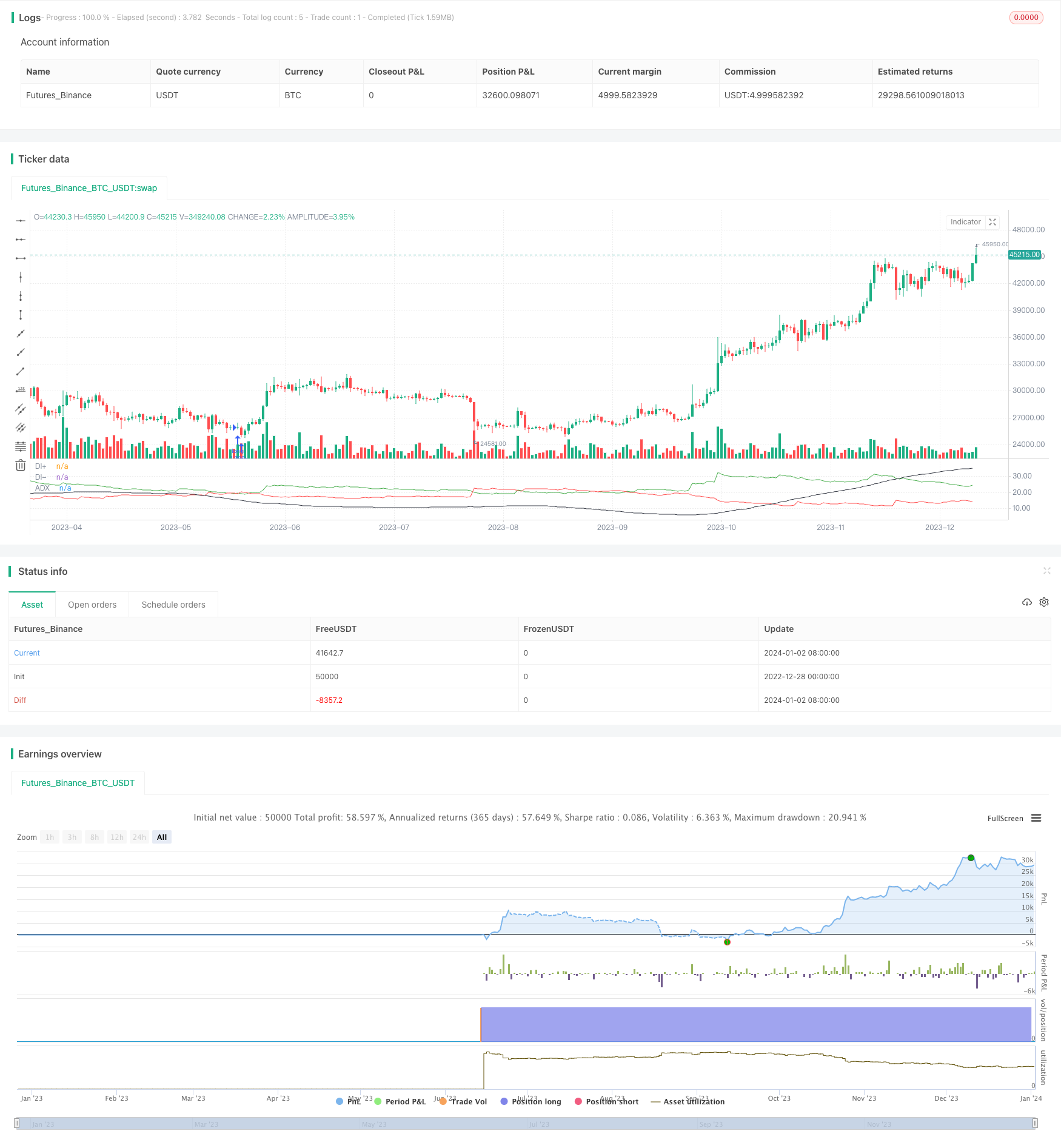

/*backtest

start: 2022-12-28 00:00:00

end: 2024-01-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Tuned_Official

//@version=4

strategy(title="DMI + HMA - No Risk Management", overlay = false, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.025)

//Inputs

hullLen1 = input(title="Hull 1 length", type=input.integer, defval=29)

hullLen2 = input(title="Hull 2 length", type=input.integer, defval=2)

len = input(title="Length for DI", type=input.integer, defval=76)

//Calculations

TrueRange = max(max(high-low, abs(high-nz(close[1]))), abs(low-nz(close[1])))

DirectionalMovementPlus = high-nz(high[1]) > nz(low[1])-low ? max(high-nz(high[1]), 0): 0

DirectionalMovementMinus = nz(low[1])-low > high-nz(high[1]) ? max(nz(low[1])-low, 0): 0

SmoothedTrueRange = 0.0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1])/len) + TrueRange

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1])/len) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus = 0.0

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1])/len) + DirectionalMovementMinus

//Indicators

fasthull = hma(close, hullLen1)

slowhull = hma(close, hullLen2)

DIPlus = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIMinus = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIPlus-DIMinus) / (DIPlus+DIMinus)*100

ADX = sma(DX, len)

//Plots

plot(DIPlus, color=color.green, title="DI+")

plot(DIMinus, color=color.red, title="DI-")

plot(ADX, color=color.black, title="ADX")

//conditions

go_long = crossover(DIPlus, DIMinus) and fasthull > slowhull //crossover(fasthull, slowhull) and DIPlus > DIMinus

go_short = crossover(DIMinus, DIPlus) and fasthull < slowhull //crossunder(fasthull, slowhull) and DIMinus > DIPlus

//Entry

if strategy.position_size < 0 or strategy.position_size == 0

strategy.order("long", strategy.long, when=go_long)

if strategy.position_size > 0 or strategy.position_size == 0

strategy.order("Short", strategy.short, when=go_short)

Detail

https://www.fmz.com/strategy/437675

Last Modified

2024-01-04 17:23:06